MATBA-ROFEX

Unlisted Corporation

Andrés Ponte - Chairman

Authorities

Chairman

Andrés E. Ponte

Vicechairman

Marcos A. Hermansson

Board of Directors

Secretary

Francisco Fernández Candia

Treasurer

Luis A. Herrera

Board Members

Ignacio M. Bosch

Marcelo J. Rossi

Alfredo R. Conde

Juan Fabricio Silvestri

Ricardo D. Marra

Sebastián M. Bravo

Gustavo C. Cortona

Leandro Salvatierra

General Manager or CEO

Diego G. Fernández

Paraguay 777, Piso 15

(2000) Rosario, Santa Fe, Argentina

Phone: 54 (341) 530-2900

www.matbarofex.com.ar

Main products and markets

Matba Rofex lists futures and options on:

- Currencies

- Commodities: Agricultural, gold and WTI

- Stock index and SSF

- Bonds and interest rates

Main shareholders

| Shareholder | Share |

| Bolsa de Comercio de Rosario | 37.1% |

Operators and brokerage firms

matbarofex.com.ar/agentes.phpTrading hours

Market data

(Additional information at www.fiabnet.org)

Brief history

Matba Rofex, Argentina´s Futures and Options Exchange, started operations on August 1st , 2019 as a result of the merger of two centenary exchanges: MATba and ROFEX. The group is formed by the Exchange, Argentina Clearing, Matba Alyc, Ufex (an Exchange in Uruguay), MATba Foundation and two IT companies: Primary and Esco. Matba Rofex has a strong technological imprint, with proprietary trading, backoffice and risk management platforms that are and fully open to enable the connection with the fintech ecosystem.

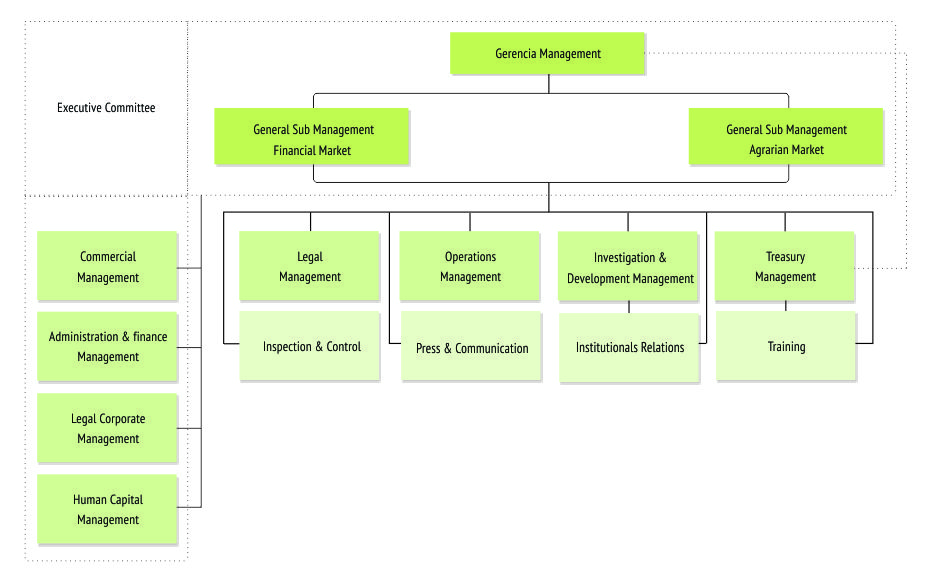

Organization chart

Clearing, settlement and depositary services

ROFEX has a separate Clearing House, known as Argentina Clearing S.A. (ACSA). Both ROFEX and ACSA are self-regulatory organizations which are under the supervision of the National Securities Commission (CNV), and they have funds settlement (MEP) accounts and securities settlement (CRyL) accounts with the Central Bank of Argentina (BCRA).

All the transactions executed on ROFEX futures exchange have central counterparty (CCP) assurance, since ACSA legally becomes buyer to every seller, and seller to every buyer, thus eliminating the bilateral nature of trading obligations.

In turn, for purposes of guaranteeing performance of executed transactions, ROFEX has established a mechanism for margin management and daily settlement (mark-to-market), whereby in case any participant fails to perform his settlement obligations, transactions executed on the futures market shall be cancelled and the relevant margins shall be settled immediately.

Central counterparty - CCP

Argentina Clearing S.A. (ACSA) is a self-regulatory organization, pursuant to Securities Public Offering Act 17811, and Executive Order 677/2001, under CNV supervision and authorized by the Commission to operate under Resolution 10278 issued on October 14, 1993. This clearing house was created in 1999 as a ROFEX spin-off for purposes of registering, clearing and settling transactions made on such futures exchange.

In order to comply with its mark-to-market system, ACSA implemented a special guarantee fund constituted by the Rosario Stock Exchange. A guarantee trust was set up with contributions made by all clearing members, thus forming a single trust fund which shall respond in case of failure to settle trades by any such member.

Likewise, creating guarantees integrated into the guarantee trust fund by clearing members for third-party transactions, as well as for obligations pertaining to each clearing member. The guarantee fund consists of initial guarantees, required margins, and surplus funds.

For purposes of strengthening legal certainty of the Clearing House, guarantee trusts were organized in order to protect funds contributed by all market participants, as safe assurance for trades registered with Argentina Clearing S.A.

Member of the following organizations

- FIA – Futures Industry Association

- AFM – Association of Futures Markets

- FIAB – Federación Iberoamericana de Bolsas

- WFE – World Federation of Echanges

- CMC – Commodities Markets Council

Agreements with other Exchanges

- License agreement on the use of settlement prices for commodities (soybean) and crude oil (petroleum) with CME – 12/19/11

- Trading Interconection Agreement with Mercado de Valores de Buenos Aires – 27/04/2014

- Trading Interconection Agreement with Mercado Argentino de Valores – 11/02/2015