Bolsa de Comercio de Rosario

Nonprofit Association

- Authorities

- Structure of the Exchange Council

- Main products and markets

- Brokerage firms

- Trading hours

- Market data

- Brief history

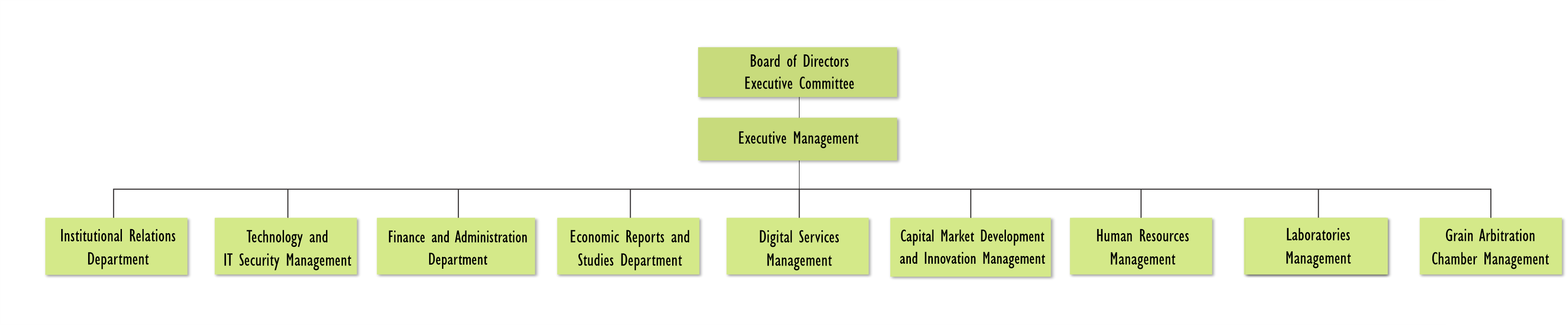

- Organization chart

- Financial indicators

- Clearing, settlement and depositary services

- Central counterparty - CCP

- Member of the following organizations

- Agreements with other Exchanges

Miguel A. Simioni - Chairman

Authorities

Chairman

Miguel A. Simioni

First Vice-Chairman

Javier A. Gastaudo

Second Vice-Chairman

Pablo A. Bortolato

Board of Directors

SecretaryMarcelo G. Quirici

First Deputy Secretary

Jorge R. Tanoni

Second Deputy Secretary

Gerardo P. Calace

Treasurer

Sebastián A. Bottallo

First Deputy Treasurer

Ivanna M. R. Sandoval

Second Deputy Treasurer

María Belén Fraga

Regular Board Members

Tomás Rodríguez Ansaldi

Martín A. Spino

Pablo H. Cechi

Hugo Fabio Morón

Alternate Board Members

María Belén Fraga

Juan Franchi

Mauro J. E. Venturi

Excecutive Manager

Javier Cervio

Córdoba 1402 (2000), Rosario, Santa Fé, Argentina

Reconquista 458 7°A, (1003) Buenos Aires, Argentina

Phone: 54 (341) 5258300/4102600

www.bcr.com.ar

Structure of the Exchange Council

Section 50 of the BCR Bylaws provides that the Governing Board shall be composed as follows:

a) By the members elected by voting, namely,

- One Chairman;

- One First Vice-Chairman;

- One Second Vice-Chairman;

- Ten regular Board members;

- Four alternate Board members;

b) By the incumbent Chairmen of BCR Arbitral Chambers;

c) By the incumbent Chairmen of BCR-affiliated Securities Market;

d) By the incumbent Chairmen of participant institutions. The Governing Board members included in paragraphs (b), (c), and (d) above have a voice, but cannot vote.

Main products and markets

(Traded on BCR affiliate markets)

- Fixed Income

- Shares

- Derivatives

- Options

- Carry-overs and Repos

- Financial trusts

- Negotiable bonds

- Agriculture Derivatives

- Diferred cheques

Trading hours

Brief history

On August 18, 1884, Centro Comercial de Rosario was founded and, in 1898, it started to be known as Bolsa de Comercio de Rosario, a forum for mercantile transactions, representing the interests of trade, production, and finance of Rosario City and the nearby region.

In 1899, Cámara Arbitral de Cereales, the oldest grain arbitration board in the country, was established with the purpose of settling disputes arising from grain purchase and sale contracts. Ten years later, Mercado a Término de Rosario SA –ROFEX- (Rosario Futures Exchange) was founded with the aim of executing grain futures transactions. With a remarkable activity in the 1920s and 1930s, ROFEX became an international price maker.

In 1927, Mercado de Valores de Rosario SA was created to settle and guarantee purchase and sale transactions in government and corporate securities. Two years later, the opening of its present-day headquarters (at the corner of Córdoba and Corrientes Streets) took place. This building was declared as public heritage because of its architectural beauty and historical importance for the city.

In 1999, Argentina Clearing SA was created as a ROFEX spin-off. Its main purpose is to guarantee the performance of ROFEX-traded futures contracts.

In 2003, Rosario Administradora Sociedad Fiduciaria SA started business operations with the purpose of making use of trusts as a financial tool.

In 2008, Mercado Ganadero SA, dubbed ROSGAN, was launched as the first domestic market through which cattle auctions are broadcast on TV.

In 2014, one of the markets associated to BCR, Merado de Valores de Rosario, changed its name to Mercado Argentino de Valores.

This change in the trade name is the outcome of the fusion by absortion with the Mercado de Valores de Mendoza (incorporated Company). The Presidents of both Markets suscribed to the Final Fusion Agreement, giving place to the creation of Mercado Argentino de Valores.

The MAV received authorization from the Comisión Nacional de Valores to work as Market, under the terms stablished in the Law N° 26.831 and statutory rules. Later, the CNV authorized the takeover of MAV’s shares.

In 2018, the Stock Exchange begins the construction of a new building, called the Harmony Building, which will become the first “green building” of Rosario, of high performance, adding vertical gardens, allowing the absorption of polluting gases, dust retention, use of rainwater and energy saving.

In 2019, the merger between the two future centennial markets of Argentina, ROFEX S.A., is carried out. As a spin-off company and the Mercado a Término de Buenos Aires S.A. (Matba) as an absorbing company, being called the new absorbing company Matba-Rofex SA This virtuous integration allows to grow the market, both in volume and liquidity, achieve greater efficiency, improve technology and the quality of agricultural and financial products that offer

Organization chart

Financial indicators

Member of the following organizations

- Federación Iberoamericana de Bolsas (FIAB) – 1980

- World Federation of Exchanges (WFE) (Correspondent Exchange) – 1981

- Asociación Panamericana de Bolsas de Productos – 1994

Agreements with other Exchanges

- Mercado Argentino de Valores S.A.: Delegation of faculties Art. 32 inc. b), f) y g) de la Ley 26,831

- Mercado a Término de Rosario S.A. (Rofex): Delegation of faculties Art. 32 inc. f) de la Ley 26,831