Latinex Group

Corporation. Member of Latinex Holdings, Inc., listed on Bolsa de Valores de Panamá.

- Authorities

- Main products and markets

- Main shareholders

- Brokerage firms

- Trading hours

- Market data

- Market capitalization split by economic sector

- Brief history

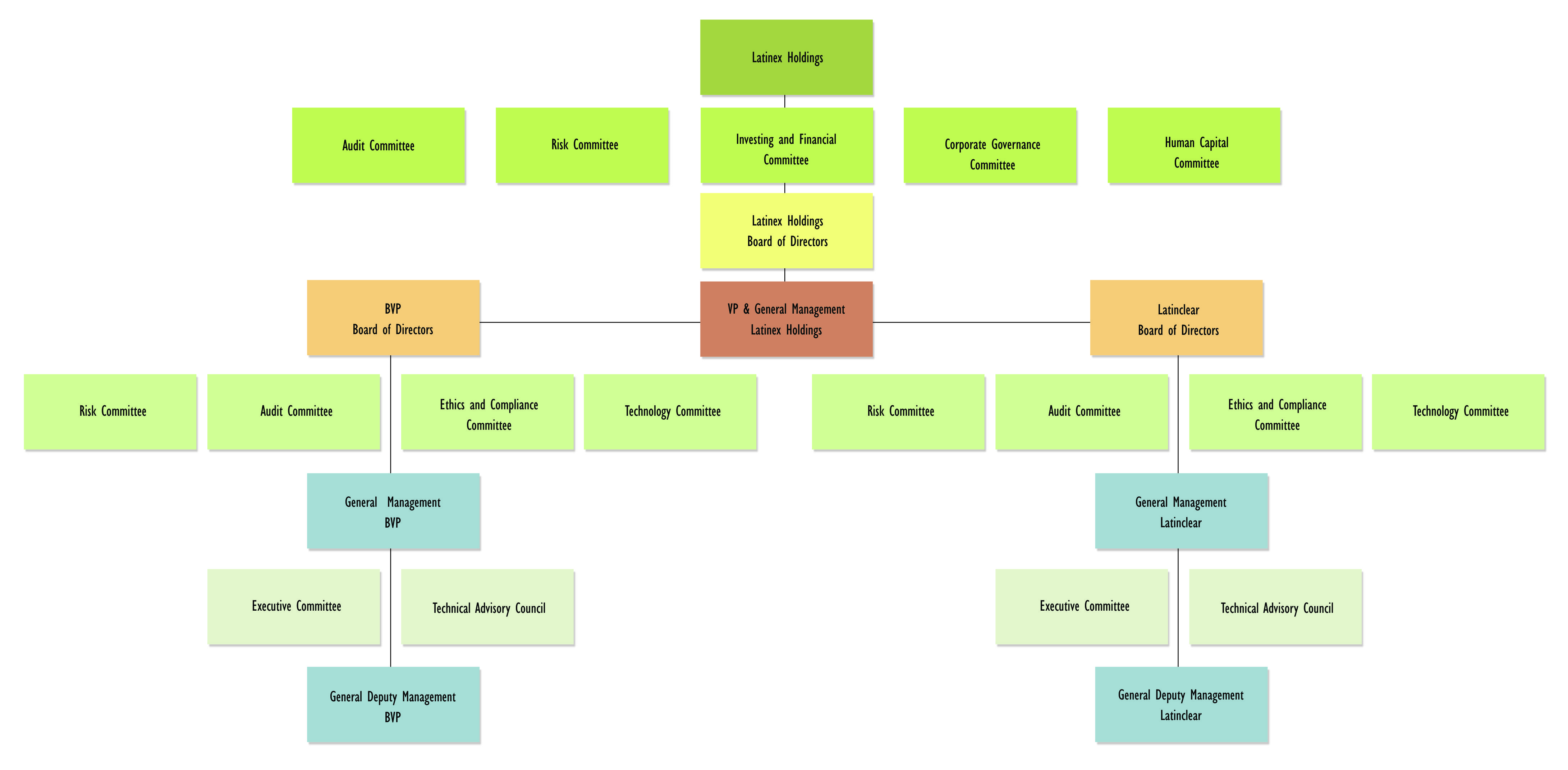

- Organization chart

- Financial indicators

- Clearing, settlement and depositary services

- Central counterparty - CCP

- Member of the following organizations

- Agreements with other Exchanges

Directors of BVP

Authorities

Chairman

Arturo Gerbaud

Vice-Chairman

Roberto Brenes P.

Treasurer

Carlos Mendoza

Secretary

Mónica García de Paredes de Chapman

Directors

Gary Chong-Hon

Jorge Vallarino

Ana Graciela Méndez

Christine Müller

Manuel Alemán

José Montero

María del Carmen de Diego

Executive President

Olga Cantillo

Av. Federico Boyd y Calle 49 Edificio Bolsa de Valores de Panamá, Panamá

Phone: (5079) 269 1966 – www.latinexbolsa.com/en/

Main products and markets

- Shares

- Fixed Income

- Reports

- Green Bonds, Social Bonds and Sustainable Bonds

Main shareholders

- Latinex Holdings Inc.

Brokerage firms

www.latinexbolsa.com/en/brokerage-firm-members/Trading hours

Brief history

1989

Foundation of Bolsa de Valores de Panama

Market data

(Additional information at www.fiabnet.org)

Market capitalization split by economic sector

Organization chart

Financial indicators

Clearing, settlement and depositary services

The liquidation model used by Latin Clear today complies with the main recommendations of the Bank for International Settlements (BIS) and others established by the International Securities Services Association (ISSA), among them, to safeguard participants from financial risks, eliminating Operational risk, reducing cost, unifying security standards and creating efficient links in the market. Latin clear uses BIS settlement model 2, of delivery against payment, which corresponds to cash netting and transaction per transaction in terms of values. The clearing and settlement period is made in T + 2. In T + 1 Latin Clear freeze titles and at the beginning of T + 2 the process is completed, through the Panama National Bank’s Clearing House. Each participant has a settlement bank that authorizes Latin Clear, through a contract, to debit them daily through this chamber to carry out its operations. Every day the Panama Stock Exchange (BVP) sends the information of the transactions and update of prices to Latin Clear through an electronic batch. The confirmation of the transactions is given in T and the BVP is responsible for making the confirmations of the stock exchange operations. The confirmations of over-the-counter transactions are made by Latin Clear in T. Latin Clear is also responsible for the deposit of securities.

Central counterparty - CCP

A Central Counterparty mechanism is not available.

Member of the following organizations

- Association of National Numbering Agencies (ANNA) – 1995

- Bolsas de Comercio de Centroamérica y el Caribe (BOLCEN) – 1990

- Federación Iberoamericana de Bolsas (FIAB) – 2005

- World Federation of Exchanges (WFE) – 1997- (Correspondent Exchange)

- America’s Central Securities Depositories Association (ACSDA)

- Climate Bonds Initiative (CBI)

- Task Force on Climate-related Financial Disclosures (TCFD)

- Sustainable Stock Exchanges (SSE)

- Instituto de Gobierno Corporativo Panamá (IGCP)

- Grupo de Trabajo de Finanzas Sostenibles (GTFS)

Agreements with other Exchanges

- Bolsa de Guayaquil – 2011 – Mutual Cooperation Agreement.

- Bolsa Nacional de Valores de Costa Rica y Bolsa de Valores de El Salvador – 2007 – Memorandum of Understanding.

- Bolsa de Nicaragua – 2007 – Memorandum of Understanding.

- Bolsas de Valores y Depositarias de El Salvador – Remote Trading agreement

- Regional Depository Custody chains with countries as Costa Rica, Nicaragua, Guatemala and El Salvador