Bolsa de Valores de Lima

Corporation listed on Bolsa de Valores de Lima

- Authorities

- Main products and markets

- Main shareholders

- Brokerage firms

- Trading hours

- Market data

- Market capitalization split by economic sector

- Brief history

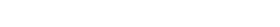

- Organization chart

- Financial indicators

- Clearing, settlement and depositary services

- Central counterparty - CCP

- Member of the following organizations

- Agreements with other Exchanges

Marco Antonio Zaldivar García - Chairman

Authorities

Chairman

Marco Antonio Zaldivar García

Vice-Chairman

José Fernando Romero Tapia

Board of Directors

Christian Thomas Laub Benavides

Juan Alberto D’angelo Serra

Roberto Eudoro Hoyle Mc Callum

Manuel Bustamante Letts

Miguel Aramburú Alvarez-Calderón

Rafael Oscar Pedro Carranza Jahnsen

General Manager

Francis Stenning de Lavalle

Phone: (511) 619-3333

www.bvl.com.pe

Main products and markets

- Common shares, ADR’s

- Investment shares (Ex Beneficial shares)

- Preferred Suscription Certificates

- Fixed Income Securities (Money market)

- Fixed Income Securities (Continuous market)

- Risk Capital Share Segment

- Short term debt – Primary Market

- Short term debt – Secondary Market

- Depository Certificates

- Alternative Stock Market

- Algorithmics

Main shareholders

| Divisio Finnancial Group S.A. |

| Participations BMV S.A. de CV Group |

| Stock Scotia |

Trading hours

Market data

(Additional information at www.fiabnet.org)

Market capitalization split by economic sector

Brief history

Bolsa de Valores de Lima traces its origins back to the Consular Court, the highest court of commerce in the 19th century, which played a crucial role in the inception of the Stock Exchange in the Capital City.

In 1857, after the liberal measures promoted by the then President of Peru, Field Marshall Don Ramón Castilla, three executive orders were passed (in 1840, 1846 and 1857) enabling the creation of the Lima Stock Exchange on December 31, 1860, which became operative on January 7, 1861.

Although in the first three decades of operation the Exchange failed to trade any kind of shares, through the Listing Committee it managed to register the nominal listings from the main marketplaces.

In 1898, as a result of the impulse given by former President Nicolas de Pierola, the Exchange recovered vigorously under the name of Bolsa Comercial de Lima. The Rules establishing the Syndicate Chamber, consisting of three merchants and three stockbrokers, were approved. Shares, bonds, and debentures were traded on the reorganized Bolsa Comercial de Lima; particularly, securities issued by banks, insurance companies, and the Peruvian government. Listing securities was the main activity conducted by the Syndicate Chamber and the Internal Affairs Committee.

The uncertainty of and sharp fluctuation in securities trading between 1929 and 1932, as well as changes occurred during and after World War II, brought about new institutional changes. The reforms started in 1945 culminated in the creation of the new Bolsa de Comercio de Lima in 1951.

In 1970, Bolsa de Valores de Lima (BVL) was established as a nonprofit private association. In 1995, BVL began trading electronically through so-called ELEX system. The year after, BVL merged with Bolsa de Valores de Arequipa. In 1997, there was a spin-off: the Central Securities Depository and Settlement Agency became CAVALI ICLV S.A. On November 19, 2002, it was agreed that Bolsa de Valores de Lima should become a corporation as from January 01, 2003.

Organization chart

Financial indicators

Clearing, settlement and depositary services

Settlement of equity cash transactions is performed by CAVALI ICLV S.A. according to a T+3 settlement term. CAVALI is also entrusted with equity securities custody, operating with wholly dematerialized book-entry issues.

Netting is multilateral, and it is performed taking into account daily securities purchases or sales executed on the secondary market. Funds settlement is a multi-bank process. At present, there are five participant Settlement Banks and the Banco Central de Reserva del Perú (BCRP) through which funds are delivered and received. Settlement is consistent with the principle of Delivery vs. Payment (DvP).

Settlement of cash transactions in fixed-income securities traded through BVL and/or DATATEC is performed by CAVALI ICLV S.A. Their settlement term may range from T+0 to T+2. However, funds settlement of such securities may be performed either directly or through CAVALI. The latter is also entrusted with the safe custody of corporate bonds and government debt securities (Treasury Bonds and sovereign bonds). In the case of certificates issued by the Central Bank of Peru (BCRP), they may be traded through DATATEC or directly between banks and the Central Bank acting as its own securities depository.

Central counterparty - CCP

A Central Counterparty mechanism is not available.

Member of the following organizations

- Federación Iberoamericana de Bolsas (FIAB) – 1973

- World Federation of Exchanges (WFE)

- Association of National Numbering Agencies (ANNA)

- Sustainable Stock Exchanges (SSE) – 2014

Agreements with other Exchanges

- Bolsa de Valores de Quito – 02/25/1999 – Inter-Institutional Cooperation

- Bolsa Boliviana de Valores – 10/08/1999 – Inter-Institutional Cooperation

- Bolsa Nacional de Valores de Costa Rica – 12/09/1999 – Inter-Institutional Cooperation

- MILA (Colombia and Chile) – 11/09/2010 – Integration

- Bolsa Mexicana de Valores and MILA – 12/05/2011 – Letter of Intent and Integration Agreement