Bolsa Boliviana de Valores

Unlisted Corporation

- Authorities

- Main products and markets

- Main shareholders

- Brokerage Firms

- Trading hours

- Market data

- Market capitalization split by economic sector

- Brief history

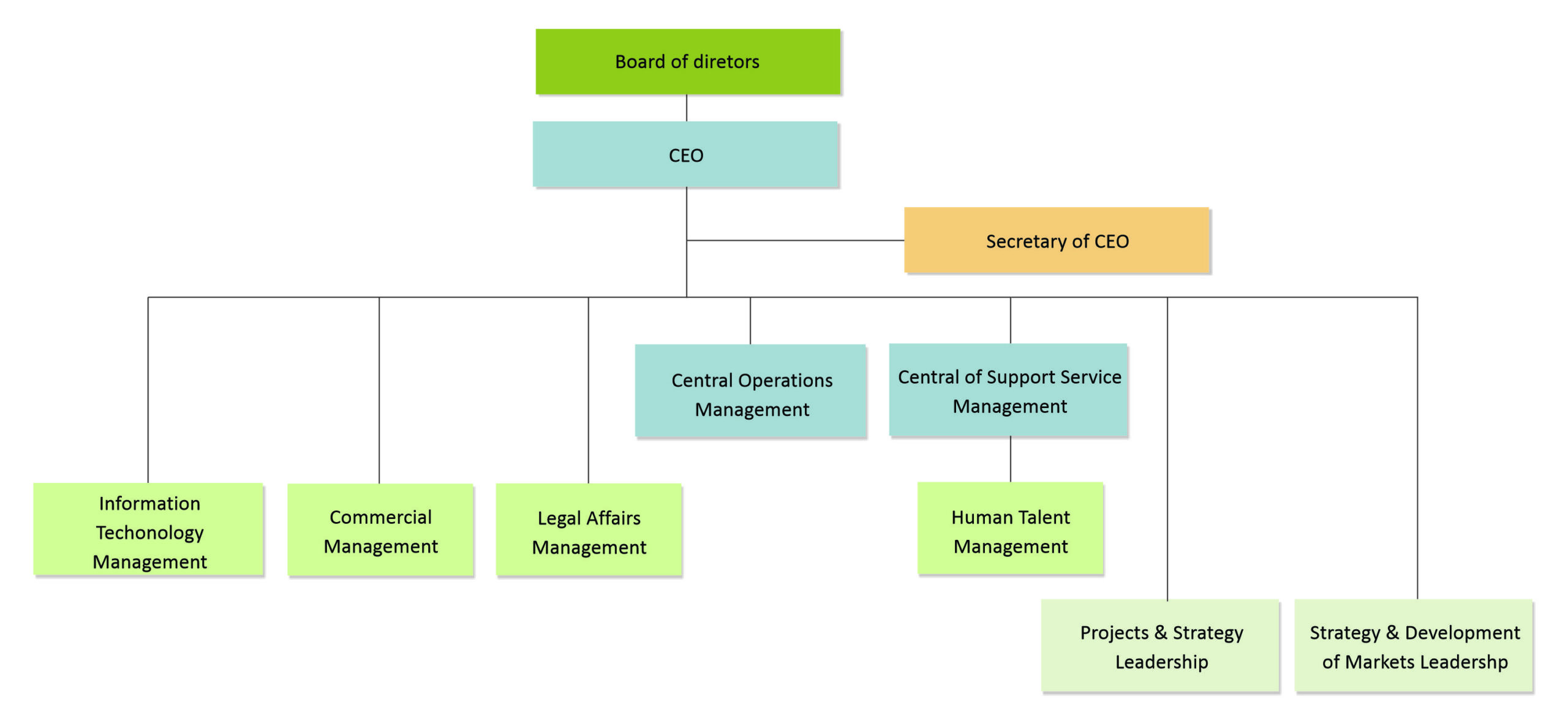

- Organization chart

- Financial indicators

- Clearing, settlement and depositary services

- Central counterparty - CCP

- Member of the following organizations

- Agreements with other Exchanges

Hugo Alejandro Morató Heredia - President of BBV

Authorities

Chairman

Hugo Alejandro Morató Heredia

First Vice-Chairman

Sebastián Campero Arauco

Second Vice-Chairwoman

Mercedes Miroslava Peña Quintanilla

Regular Directors

Yalú Galarza Mauri (Secretaria)

Jorge Hinojosa Jiménez

Pamela Carola Terrazas López Videla

Independent Directors

Javier Villanueva Pereira

Elbio Pérez López

Regular Statutory Auditors

Evelyn Grandi Gómez

David Suárez Pérez

Legal Councel

Javier Urcullo

General Manager or CEO

Pablo Irusta Zambrana

Avenida Arce 2333 Casilla Postal 12521, La Paz, Bolivia

Phone: (591-2) 2443232 www.bbv.com.bo

Main products and markets

- Fixed Income

- Shares

- Trading desk (S&MC)

Main shareholders

| Banco de Desarrollo Productivo S.A.M. – Bdp S.A.M. – Banco de Segundo Piso | 9.84% |

| BDP Sociedad de Titularización S.A. | 9.84% |

| Banco Bisa S.A. | 9.22% |

| Sudaval Agencia de Bolsa S.A. Sudaval S.A. | 7.58% |

| Banco de Crédito de Bolivia S.A. | 7.38% |

| Banco Mercantil Santa Cruz S.A. | 7.38% |

| Otros | 48.76% |

Brokerage Firms

www.bbv.com.bo/agenciasTrading hours

Market data

(Additional information at www.fiabnet.org)

Market capitalization split by economic sector

Brief history

On April 19, 1979, the Bolivian Confederation of Private Businessmen (CEPB), chaired by Marcelo Pérez Monasterios, founded the Bolivian Stock Exchange (BBV S.A.). Established as a nonprofit corporation, the Bolivian Bolsa initially consisted of 71 members holding only one share each, and capital stock totaling B$ 1.42 million. The first Shareholders’ General Meeting was held on the same foundation date. At such meeting, the Draft Bylaws and the first Board of Directors were approved. On August 2, 1979, under Decree-Law 16995 issued by the Finance Ministry, the National Securities Commission was created as a government agency entrusted with the regulation, supervision, and oversight of the Securities Market, the Stock Exchange, and market intermediaries. However, the Board of Commissioners was set up only in 1982, when Lic. Manuel Arana was appointed as Chairman of the Board. Pursuant to Board Resolution No. 002/89 dated October 17, 1989, the National Securities Commission authorized the initial trading of securities on the Bolsa Boliviana de Valores S.A. as from October 20, 1989. The first BBV S.A. floor transaction was executed on November 16, 1989, consisting in the purchase and sale of Negotiable Certificates of Deposit issued by the Central Bank of Bolivia (CEDES), which was then trading directly on the Exchange floor.

Organization chart

Financial indicators

Clearing, settlement and depositary services

All transactions are settled on T+0, considering all financial instruments. Book-entry securities trades are settled through the Bolivian CSD, Entidad de Depósito de Valores de Bolivia S.A. (EDV). Transactions in physical securities are settled broker-to-broker.

Central counterparty - CCP

A Central Counterparty mechanism is not available.

Member of the following organizations

- Bolivian Confederation of Private Businessmen (CEPB)

- American Chamber of Commerce (AMCHAM)

- Santa Cruz Chamber of Industry, Commerce and Tourism (CAINCO)

- Ibero-American Federation of Exchanges (FIAB)

Agreements with other Exchanges

- Agreement with Bolsas y Mercados Españoles -BME-, use and service license for an electronic negociation system named SMART