Bolsa de Valores de Quito

Nonprofit corporation. Membership units are traded on Ecuadorean Stock Exchanges.

- Authorities

- Main products and markets

- Brokerage firms

- Trading hours

- Market data

- Market capitalization split by economic sector

- Brief history

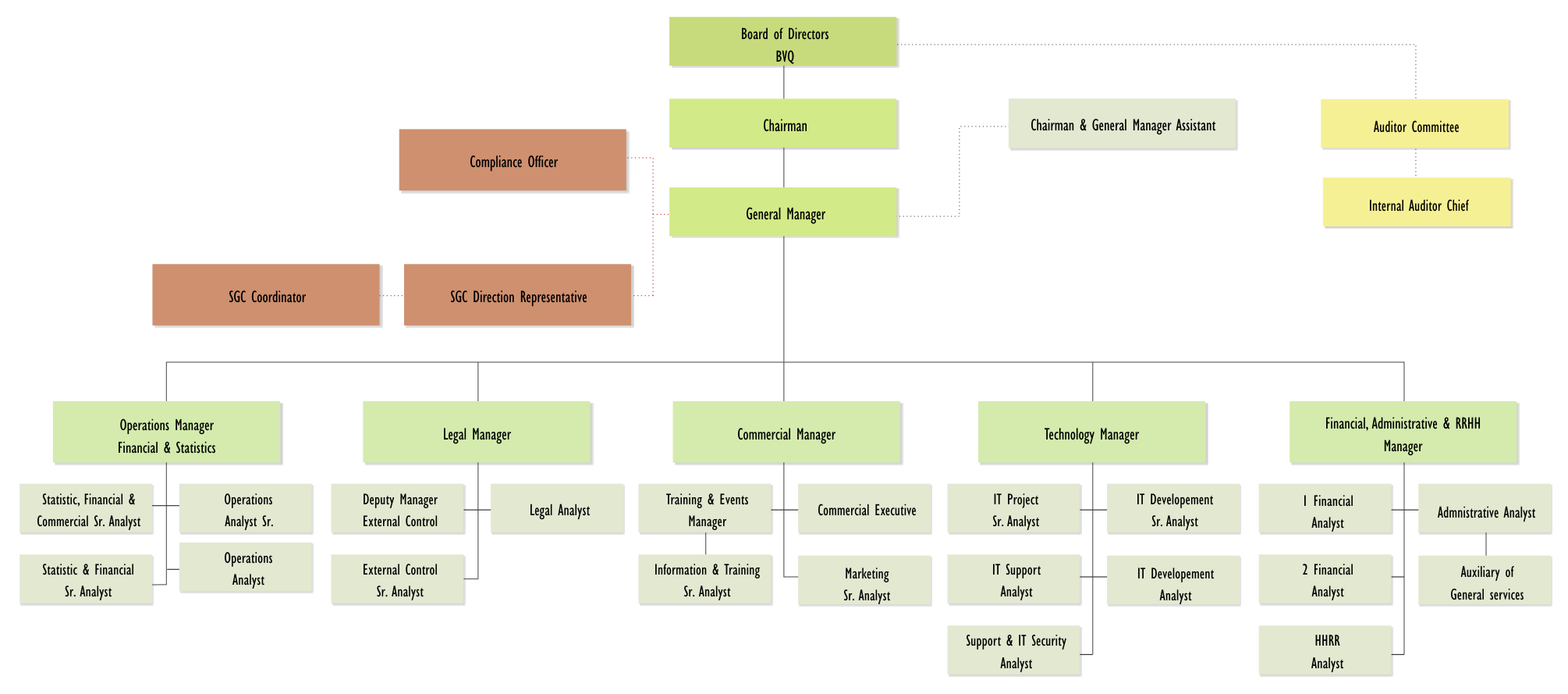

- Organization chart

- Financial indicators

- Clearing, settlement and depositary services

- Central counterparty - CCP

- Member of the following organizations

- Agreements with other Exchanges

Diana Torres Proaño - Chairwoman

Authorities

Chairman

Diana Torres Proaño

Board of Directors – External

Regular Board Members

Paul McEvoy

María Isabel Parra

Carlos Loayza

Bernardo Gómez

Alternate Board Members

Andrés Domínguez

Max Proaño

Board of Directors – Internal

Regular Board Members

Daniella Cruz

César Morales

Alternate Board Members

María del Carmen Astudillo

General Manager

César Robalino Aguirre

Av. Río Amazonas 21-252 (y Carrión)

Edificio Londres, 8th floor, A.P. (3772) Quito, Ecuador

Phone: (5932) 3988500

www.bolsadequito.info

Main products and markets

- Shares

- Membership units

- Global bonds

- Government bonds

- Credit notes

- Securitization

- CDS

- Investment certificates

- Saving policies

- Promissory notes

- Saving certificates

- Bills of exchange

- Financial certificates

- Guaranteed liabilities certificate

- Treasury certificates

- Coupons

- Debentures

- Convertibles bonds into shares

- Special register of non-registered securities

- Commercial papers

- Participating shares

- Preferred stocks

- Short term fixed income

Trading hours

Ask Auction

Bid Auction

Unregistered Securities Auction (Revni)

Market data

(Additional information at www.fiabnet.org)

Market capitalization split by economic sector

Brief history

In law terms Bolsa de Valores de Quito has got three special relevant moments. The first one was related to its first foundation, which took place in 1969 as Corporation, as an initiative of Comisión de Valores – Corporación Financiera Nacional (as named at that moment).

Twenty years later, in 1993, the new Capital Market Law, restructured Ecuadorian Capital Market establishing that exchanges should be transformed into non profit civil corporations. That’s why since May, 1994, the Exchange became Corporación Civil Bolsa de Valores de Quito, considering this fact as its second foundation.

Organization chart

Financial indicators

Clearing, settlement and depositary services

Bolsa de Valores de Quito provides these services through a third-party agreement with two institutions, Decevale and DCV, which are subject to the regulations established by Bolsa de Valores de Quito for such purpose.

Trade Settlement

All the transactions must be settled and completed by private brokerage firms or public sector institutions under the terms and conditions set forth in settlement contracts and transactional system records.

Once a transaction is closed, the settlement system will generate a settlement invoice containing, among other data, net value of purchase and sale transactions, involved brokerage firms, name of broker-dealer, and so on.

Pursuant to an Internal Revenue Service resolution, settlement shall be considered to be an invoice. Therefore, it shall also be governed by the provisions included in the Rules on Sales and Tax Withholding Certificates.

BVQ shall settle stock-exchange transactions based on the positive or negative balance resulting from subtracting the total value of purchases and sales executed on value date.

The settlement process shall be conducted through the magnetic funds transfer system between the BVQ account with the Central Bank of Ecuador and the current accounts of brokerage firms or public institutions within the financial system.

Settlement is performed on the basis of prior calculation of net value, which takes into account the cash value of transactions, commissions, and other items that may be deducted from the latter.

Clearing Mechanisms

BVQ may perform trade clearing through the following mechanisms:

a. Delivery versus payment under gross settlement: Clearing is performed through simultaneous cash and securities debits from and credits to the accounts of buying and selling brokers.

b. Securities delivery under daily net settlement: Clearing is performed through delivery of traded securities from selling to buying broker, and determination of daily net cash value on behalf or for the benefit of each brokerage firm or public sector institution. The daily net cash value shall result from clearing all the transactions to be performed or executed on such date, and it shall be paid through a disbursement or charge, from the BVQ account.

c. Direct delivery of securities and funds: Delivery is made by the parties directly involved in a securities and cash transaction, and through a different mechanism from those mentioned in the foregoing paragraphs. This type of clearing shall be applicable under prior request of and specific authorization from BVQ, and it shall require compliance with expressly stating that securities were received to the satisfaction of said parties. This mechanism is used in cross trades, and with deferred payment terms.

Central counterparty - CCP

A Central Counterparty mechanism is not available.

Member of the following organizations

- Federación Iberoamericana de Bolsas (FIAB) – 1973-1991/1994

- Association of Certified Anti-Money Laundering Specialists ACAMS – 2009

- Consejo de Cámaras y Asociaciones de la Producción – 2010

- Cámara de Industrias y Producción – 2011

- Red de Institutos de Gobierno Corporativo Latinoamericano

Agreements with other Exchanges

- Confederación Colombiana de Cámaras de Comercio – February 2006 – Project for the Promotion of Good Corporate Governance Practices.

- Corporación de Promoción de Exportaciones e Inversiones CORPEI – March 2006 – Cooperation Agreement on Foreign Direct Investment Promotion.

- Inter-American Development Bank – August 2006 – Non-Reimbursable Technical Cooperation Agreement on the Development of Supply and Demand for Good Corporate Governance Practices in Ecuador.

- Corporación Andina de Fomento – November 2008 – Non-Reimbursable Technical Cooperation Agreement to provide Technical Assistance under the Securities Market Modernization Project and Creation of the Corporate Governance Academic Unit.

- Institutos de Gobierno Corporativo de Latinoamérica (IGCLA) – March 2012 – Memorandum of Understanding and Cooperation Agreement on the Creation of the Latin- American Network of Corporate Governance Institutes.