Bolsa Nacional de Valores (Costa Rica)

Unlisted Corporation

- Authorities

- Main products and markets

- Main shareholders

- Brokerage firms

- Trading hours

- Market data

- Market capitalization split by economic sector

- Brief history

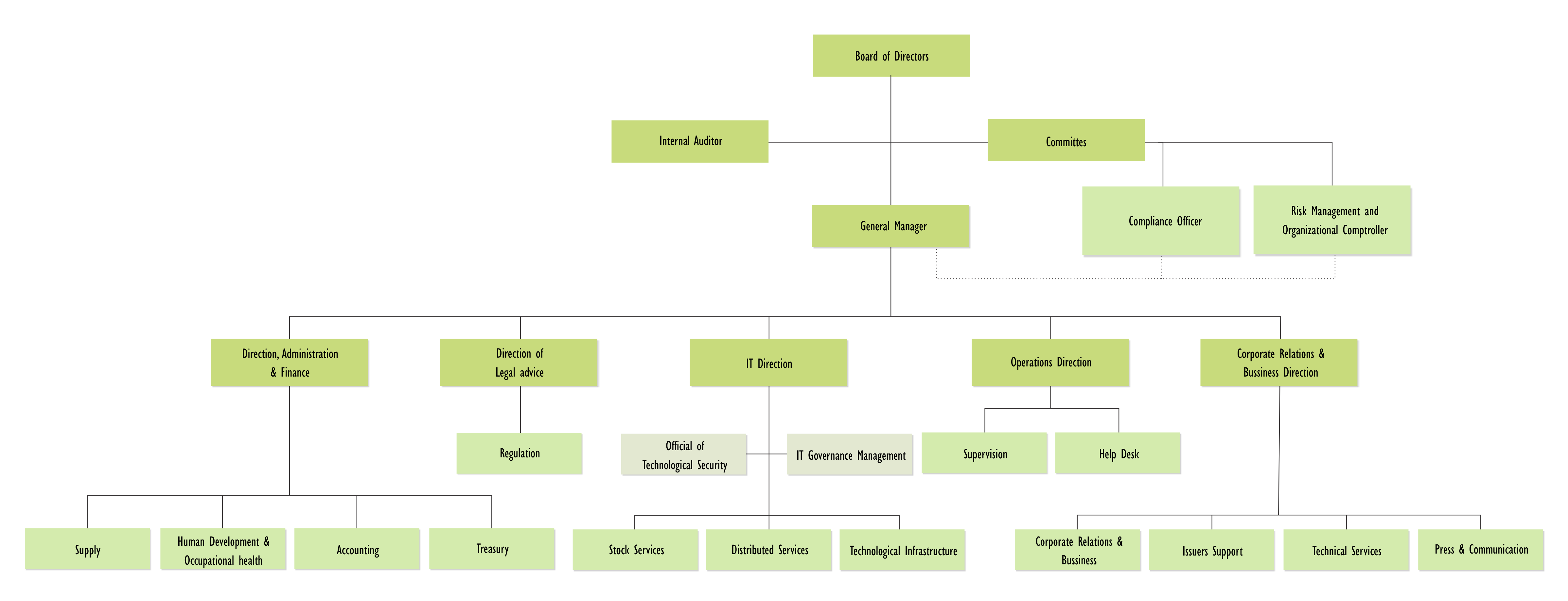

- Organization chart

- Financial indicators

- Clearing, settlement and depositary services

- Central counterparty - CCP

- Member of the following organizations

Roberto Venegas - Chairman

Authorities

Chairman

Roberto Venegas Renauld

Vice-Chairman

Cristina Masís Cuevillas

Board of Directors

Vanessa Olivares Bonilla

Arturo Giacomín Zúñiga

Jennifer Campos Ulate

Orlando Soto Solera

Oscar Melvin Garita Mora

Alejandro Solórzano Mena

Ariel Vishnia Baruch (Fiscal)

Yancy Cerdas Martínez (Fiscal)

Amedeo Gaggion Azuola (Fiscal)

CEO

César Restrepo Gutiérrez

Edificio BNV, Parque Empresarial Forum

A.P. 03-6155, San José, Costa Rica

Phone: (506) 2204-4848

www.bolsacr.com

Main products and markets

- Shares

- Fixed income

- Investment fund units

Main shareholders

Brokerage firms are the main shareholders of the Exchange.Brokerage firms

www.bolsacr.com/inversionistas/puestos-autorizadosTrading hours

| Trading board | Board description | Schedule |

| ACEP | Bank acceptances – OTC & nonstandard | 10:00 to 13:00 |

| CFDS | Non Delivery FX Forwards | 08:30 to 16:30 |

| CORE | Secondary tradingof standardized Debt, Mutual Funds & Equity settled on T2 – T3 | 10:00 to 13:00 |

| COVE | Secondary trading of standardized Debt, Mutual Funds & Equity settled on T1 (Equity securities are settled in t+2 ) | 09:30 pre-open 10:00 to 13:00 |

| FOEX | Foreign exchange USD/CRC | 08:00 to 16:00 |

| LICI | Primary Bidding. New issuance of standardized Debt, Mutual Funds and Equity. | 08:00 to 17:00 |

| LIQ | Secondary purchase & sale board for money cross settled | 10:00 to 13:00 |

| MEDI | Repurchase Agreement in which the security is placed in a trust. First Leg settlement term: T0 | 11:00 to 15:00 |

| NICI | Secondary trading of International securities deposited at InterClear international custody accounts but not enrolled in RNVI. (unregistered securities) | 09:00 to 15:00 |

| RREP | Repurchase Agreement in which the security is placed in a trust. First Leg settlement term: T1 | 10:00 to 13:00 |

| VECO | Securities lending market | 10:00 to 12:00 |

| TNE | Secondary market for non-standardized debt instruments. (Continuous Matching board) | 10:00 to 13:00 |

| RTNE | Secondary market for non-standardized debt instruments (Auction after TNE matches) | 10:00 to 13:00 |

| VELP | Primary Bidding. New issuance of non – standardized debt (not enrolled in RNVI) | 10:00 to 15:00 |

Market data

(Additional information at www.fiabnet.org)

Market capitalization split by economic sector

Brief history

The first attempts to establish a Stock Exchange in Costa Rica date back to the 1940s, when the Bolsa de Valores de San José was created. However, this Exchange operated for only one year. Some time later, in September 1970, a group of businessmen who were members of the National Chamber of Finance, Investment and Credit (CANAFIC) founded the Bolsa Nacional de Valores (BNV). The Exchange suffered initial setbacks when it started trading, mainly because substantial capital was required to design and execute its infrastructure as a whole. With the advent of the Costa Rican Development Corporation (CODESA), the Exchange seized the opportunity to begin operations, and therefore in 1974, the Central Bank publicly offered the Exchange’s shares for sale, which were totally purchased by said government agency. Thereafter, CODESA made the relevant steps to put the Exchange in full operation. It hired the advisory services of the Organization of American States (OAS) to perform the corresponding feasibility studies. Once the analysis and the organization were completed, the Exchange held its first session on August 19, 1976, and it was officially inaugurated on September 29, that same year, by the then President of Costa Rica, Lic. Daniel Oduber Quirós.

Pursuant to the legal framework established in the Commercial Code as effective at the time, BNV was organized as a Stock Exchange, which empowered it to trade not only securities but also other types of goods and services. However, as part of the “economic democratization” process developed during the Administration of former President Rafael Ángel Calderón Fournier (1990-1994), on May 27 and 28, 1993, the shares held by CODESA (40%) were sold to private investors; which means that today BNV is wholly owned by private entities.

At present, the Costa Rica National Exchange is a private company whose purpose is to be a facilitator of transactions in securities or any other economic interests, whether embedded in the securities or not, and an important promoter of capital market development.

With 40 years of experience, our stock market is the oldest in the central american region.

The Bolsa Nacional de Valores is governed by a Board of Directors that is elected through the General Shareholders’ Meeting. The General Manager and a group of executive officers are responsible for the operation, administration and performance of the Exchange.

This infrastructure has been strengthened over the last years with the emergence of institutional investors, such as mutual funds and pension funds which, in addition to being a major component in securities demand, promote long-term securities issues.

Green Bonds

The National Stock Exchange of Costa Rica defined a standard for the green bonds emission, based on the Green Bond Principles (GBP-ICMA) in order to provide transparency and confidence to the investors. Through this new instrument, the Exchange promotes the financing of green projects in Costa Rica through the stock market.

Find attached:

Standard for the emission here

Video about Green Bonds here

Green bonds section here

Corporate Social Responsibility:

The National Stock Exchange aware of the need to advance in practices that lead to sustainable development, it promotes projects that generate economic, social and environmental value.

Stock exchange education: During the last years the Exchange has provided textbooks, school supplies and computer labs to different schools. In addition, improvements were made in classroom infrastructure, and we committed ourselves to support the schools with different requirements.

On the other hand, the Exchange, support new entrepreneurs as a jury and sponsor of the Seedstars Costa Rica edition, an event that awards innovative small entrepreneurs with potential projects.

In addition, the Exchange realize the Stock Market Championships, this activity seeks to show to young people knowledge about the stock market. More than 2,000 students from colleges and universities are benefited from this program every year.

Finally, workshops and talks related with the stock market topics were held face-to-face with university students, school students, professionals from different areas and journalists.

Innovation: In 2017 the Brand Map was established, and in it, innovation is a fundamental element that generates value to the company. The Exchange promotes that employees submit innovative proposals that provide new businesses.

Corporate governance: In compliance with the Corporate Governance Regulation, issued by the CONASSIF, the organization clarified some structures, reviewed internal polices a promoted transparency in the disclose of information. Through the Corporate Governance Code guarantees the best practices that includes:

– Definition of the responsibilities and functions of the Board of Directors, Senior Management, Technical Committees and support units, as well as the professional profile of its members.

– The policies that guide corporate governance actions, including those related to the nomination of Board members, their remuneration and the evaluation of their performance.

With the objective of verified this and other actions the whole documentation is reviewed and approved by the SUGEVAL (regulator).

Environment: In the company waste and recycling selection systems are available, and employees are motivated to save water, energy and other resources. The building has changed to LED lights, and this has generated a considerable reduction in the consumption of electrical energy and consequently in billing.

On-Line training “BNV Aprenda”

BNV Aprenda is a form of self-taught training through the internet service, which allows a direct interaction with users interested in learning about the Costa Rican Stock Market. You can access from your mobile devices here

Organization chart

Financial indicators

Clearing, settlement and depositary services

BNV provides two types of trade settlement. For cash (spot) debt securities transactions, securities payment and delivery must be performed before the end of the next day after trade date, that is to say, T+1. For cash (spot) equities transactions, settlement is carried out on T+3.

BNV also provides settlement facilities for longer-term transactions, up until 360 days. This is allowed within the Exchange’s trading system, which enables issuers to be more flexible as to settlement date, if necessary. These transactions are identified as “Forward Trades”.

The settlement is carried out through the stock market, but the escrow agent is separate. From November 2015, it began operations Interclear Central de Valores S.A a new value depositary which replaces the old CEVAL. Interclear is an independent company of the Bolsa Nacional de Valores and operates as annotation on private account, and deposit of securities.

The Exchange has a 40% stake in the share capital of Interclear and the remaining 60 % is provided by clearing members (banks and brokerage firms).

There is also in our market-entry System (SAC), which is administered by the Central Bank and in which public issues are recorded. The remaining emissions are recorded in Interclear Central de Valores SA

Central counterparty - CCP

A Central Counterparty mechanism is not available.

Member of the following organizations

- Ibero-American Federation of Exchanges (FIAB) – 1995

- Association of Central American and Caribbean Exchanges (BOLCEN) – 1995

- Member of SSE (Sustainable Stock Exchanges Initiative) – 2018