Bolsa de Valores de Colombia

Corporation listed on Bolsa de Valores de Colombia

- Authorities

- Main products and markets

- Main shareholders

- Brokerage firms

- Trading hours

- Market data

- Market capitalization split by economic sector

- Brief history

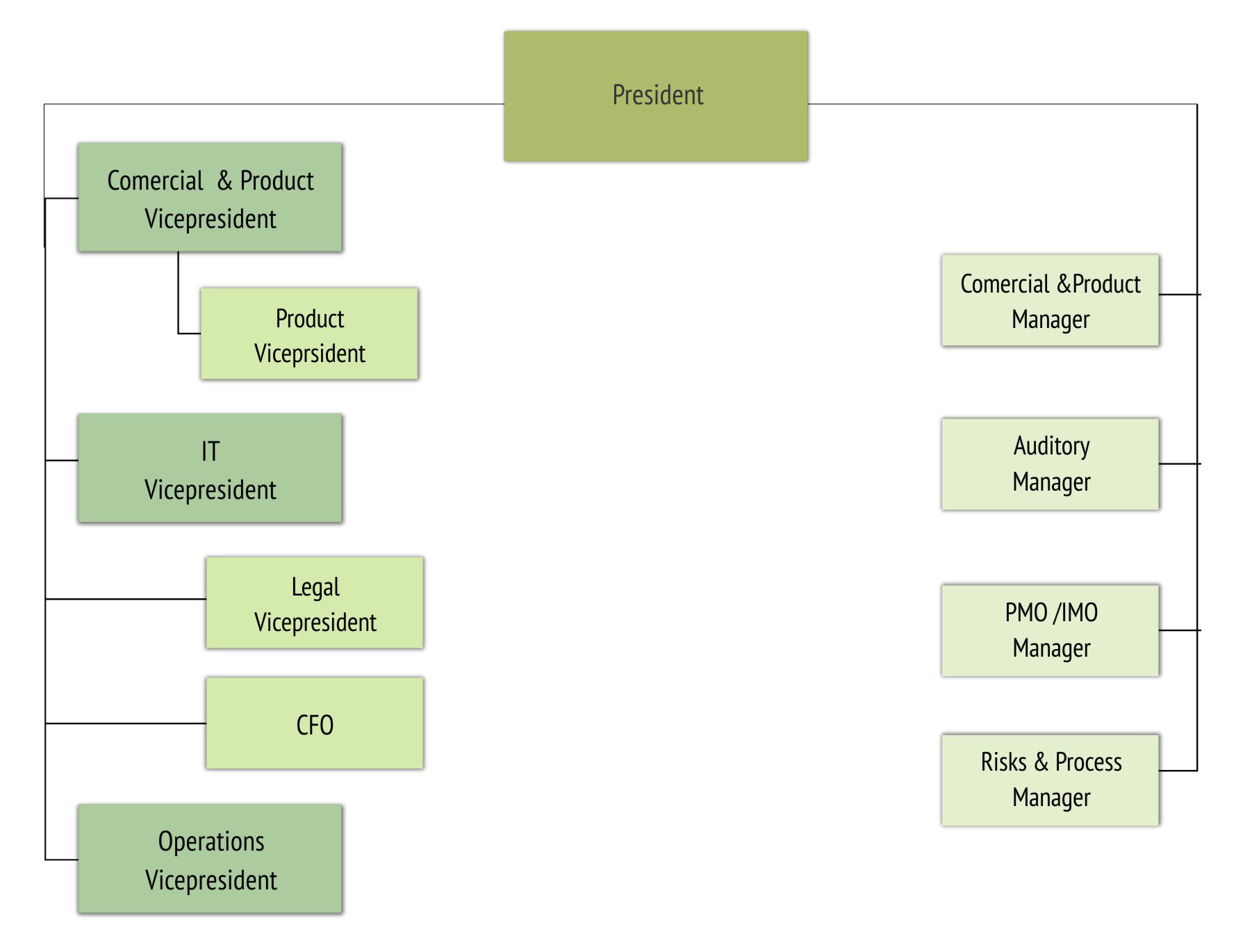

- Organization chart

- Financial indicators

- Clearing, settlement and depositary services

- Central counterparty - CCP

- Member of the following organizations

- Agreements with other Exchanges

Juan Pablo Córdoba - CEO

Authorities

President

Rafael Aparicio Escallón

Board of Directors

Independent Directors

Sergio Clavijo Vergara

Julián Domínguez Rivera

Carlos Eduardo Jaimes Jaimes

Javier Jaramillo Velásquez

Roberto Junguito Bonnet

Santiago Montenegro Trujillo

Juan Camilo Vallejo Arango

Non-Independent Directors

Mauricio Rosillo Aura Arcila

Giraldo Germán Salazar Castro

Rafael Aparicio Escallón

Diego Jimenez Posada

Juan Luis Franco Arroyave

CEO

Juan Pablo Córdoba Garcés

Carrera 7 71-21 Torre B Oficina 1201 Bogotá, Colombia

Phone: (571) 313-9800 www.bvc.com.co

Main products and markets

Equity: Shares Repos Securities Lending MILA (Latinamerican Integrated Market) CGM (Colombian Global Market) ETFs

Fixed Income: Government bonds Corporate bonds CDTs, BOCEAS Repos Simultaneous Securities Lendings

Derivatives: Futures on: Government bonds Currencies Shares Indexes Interests Rates Inflation Rates

Currencies: Dolar Spot Dolar Next Day Forwards

Main shareholders

| Foreign Investment Funds | 39% |

| Brokerage Firms | 16% |

| Pension Funds | 16% |

| Corporate Portfolio | 16% |

| Natural Persons | 5% |

| Universities | 7% |

| Mutual Funds | 1% |

Brokerage firms

www.bvc.com.co/pps/tibco/portalbvc/Home/ComisionistasyAfiliados/Listado_ComisionistasTrading hours

Market data

(Additional information at www.fiabnet.org)

Market capitalization split by economic sector

Brief history

Bolsa de Valores de Colombia (BVC) is a multi-product Exchange created in 2001 as a result of the merger between the Bogota, Medellin, and Occidente Stock Exchanges. BVC has drawn from the experience and tradition of more than 80 years of stock market history in Colombia. BVC has been a listed company since 2007, with 18.7 billion outstanding shares, 85% free float, and more than 200 shareholders. BVC manages the trading platforms for the equities, fixed income, and derivatives markets; and through subsidiaries which have been created as a result of strategic alliances with other companies, it also operates the energy commodities and foreign exchange markets in Colombia. Strategically, BVC is the largest shareholder of companies that are part of the whole value chain in the Colombian capital market; its main purpose being to increase the number of products through strategic alliances in Colombia and abroad, thereby creating value for its shareholders. BVC supplemented its strategic planning with broad foresight, with respect to business development in accordance with the objectives of internationalizing the Colombian securities market, developing the value chain, and becoming a high-recall company with close and loyal customer relationships. In terms of international leadership, BVC is a member of the Latin American Integrated Market (MILA), together with Bolsa de Comercio de Santiago, Bolsa de Valores de Lima, and central securities depositories from the three countries. BVC actively participates in industry forums, it is a member of the World Federation of Exchanges (WFE) and it is currently serving as President, and the Ibero-American Federation of Exchanges (FIAB) and it is currently serving as President.

Organization chart

Financial indicators

Clearing, settlement and depositary services

Explanatory table showing the Colombian securities clearing, settlement and custody scheme:

For the equity market, BVC trade settlement is performed on T+3 through the central securities depository DECEVAL. For the fixed income market, settlement is performed on T+0 through central bank Banco de la República, and central securities depositories DCV and DECEVAL.

Central counterparty - CCP

Bolsa de Valores de Colombia has a Central Counterparty mechanism available for derivatives and foreign exchange markets. For the derivatives market, settlement is performed on T-date through the CCP clearing house Cámara de Riesgo Central de Contraparte (CRCC). For the FX market, settlement is performed on T+1 through the Colombian foreign exchange clearing house Cámara de Compensación de Divisas de Colombia (CCDC).

Member of the following organizations

- Mercado Integrado Latinoamericano (MILA) – 2010

- World Federation of Exchanges (WFE) – 2004

- Federación Iberoamericana de Bolsas (FIAB) – 2001*

* Year of merger between Bogotá, Medellín and Occidente Stock Exchanges, forming Bolsa de Valores de Colombia.

Agreements with other Exchanges

- BM&FBOVESPA – 2011 – Memorandum of Understanding for interconnected work in Shares, Fixed Income and Derivatives.

- TMX-TSX – 2012 – Memorandum of Understanding to share information between Exchanges from Colombia and Canada.