Bolsa Electrónica de Chile

Fernando Enrique Cañas Berkowitz - President

Authorities

President

Fernando Enrique Cañas Berkowitz

Vicepresident

Jose Miguel Alcalde Prado

Board of Directors

Hernan Arellano Salas

Fred Meller Sunkel

Javier Moraga Klenner

Carlos Portales Echeverría

Gonzalo Peña Lertora

Guillermo Tagle Quiroz

Rodrigo Valdes Pulido

CEO

Juan Carlos Spencer Ossa

Huéfanos 770, piso 14, Santiago de Chile, 8320193

Tel: +562 24840110

https://www.bolchile.com/

Main shareholders

Banchile Corredores De Bolsa S.A., Bancoestado S.A., Corredores De Bolsa, Bci Corredor De Bolsa S.A., Bice Inversiones Corredores De Bolsa S.A., Btg Pactual Chile S. A. Corredores De Bolsa, Cb Corredores De Bolsa S.A., Chg Asesorias E Inversiones Limitada, Chile Market Corredores De Bolsa Spa, Compass Group Chile Inv Ltda Y Cia En Comandita Por Acciones, Consorcio Corredores De Bolsa S.A., Credicorp Capital S.A. Corredores De Bolsa, Efg Corredores De Bolsa Spa, Euroamerica Corredores De Bolsa S.A., Ing Bank N V, Inversiones Jp Morgan Limitada, Inversiones Ultra S.A., Itau Corredores De Bolsa Limitada, Larrain Vial S.A. Corredora De Bolsa, Mbi Corredores De Bolsa S.A., Mcc Sa Corredores De Bolsa, Moneda Corredores De Bolsa Limitada, Nova Scotia Inversiones Limitada, Renta 4 Corredores De Bolsa S.A., Santander Corredores De Bolsa Limitada, Scotia Corredora De Bolsa Chile Limitada, Sintra S.A., Tanner Corredores De Bolsa S.A., Toesca Agencia De Valores Spa, Valores Security S A Corredores De Bolsa, Vantrust Capital Corredores De Bolsa S.A., Vector Capital Corredores De Bolsa S.A., Velox Servicios Financieros S.A., Zurich Servicios E Inversiones S.A.Brokerage firms

www.bolchile.com/corredoresTrading hours

Brief history

Since its creation in 1989, Bolsa Electrónica de Chile has been a pioneer in innovation at the service of the financial industry. It was the first stock exchange to operate online and remotely for more than 30 years ago, and since then, it has promoted the development of the local and regional stock market, introducing new products and services to support stockbrokers for the benefit of investors in our country.

Bolsa Electrónica de Chile generates negotiation instances and facilitates financial intermediation through different activities such as the purchase and sales of financial instruments. Additionally, it allows buyers and sellers to contact each other in order to finance different types of businesses, providing legal security in accordance with current regulations.

One of the key milestones in the history of Bolsa Electrónica de Chile is the strategic alliance with SIF ICAP that allows the application in Chile of the current transaction system and its derivatives, known as Datatec.

In 2011, the BEC took another significant step in its expansion, reaching an agreement with the North American Nasdaq stock Exchange, whose technology is used by more than 70 countries around the world. With this, Bolsa Electrónica de Chile becomes the stock exchange with the highest processing speed in Latin America. The alliance with Nasdaq has contributed to remain at the forefront of technology while incorporating, over time, new services that are available to the local stock market.

In 2019, it signed a cooperation agreement with Sonda to integrate the RealAISCdB platform, a Sonda tool aimed at managing stockbrokers’ back office with the Electronic Stock Exchange (BEC) technological systems.

In recent years, BEC has promoted competition and transparency in the Chilean stock market, promoting initiative such as the interconnection of stock exchange at local and regional level.

Throughout its history, Bolsa Electrónica de Chile has advanced in line with its digital DNA. The health crisis associated with Covid – 19 has demonstrated its ability to continue delivering a first-rate service, 100% remote, with all of its staff working from home. The ability to adapt to exceptional situations such as a pandemic motivated Nasdaq to recognize Bolsa Electrónica as a global example in the stock market.

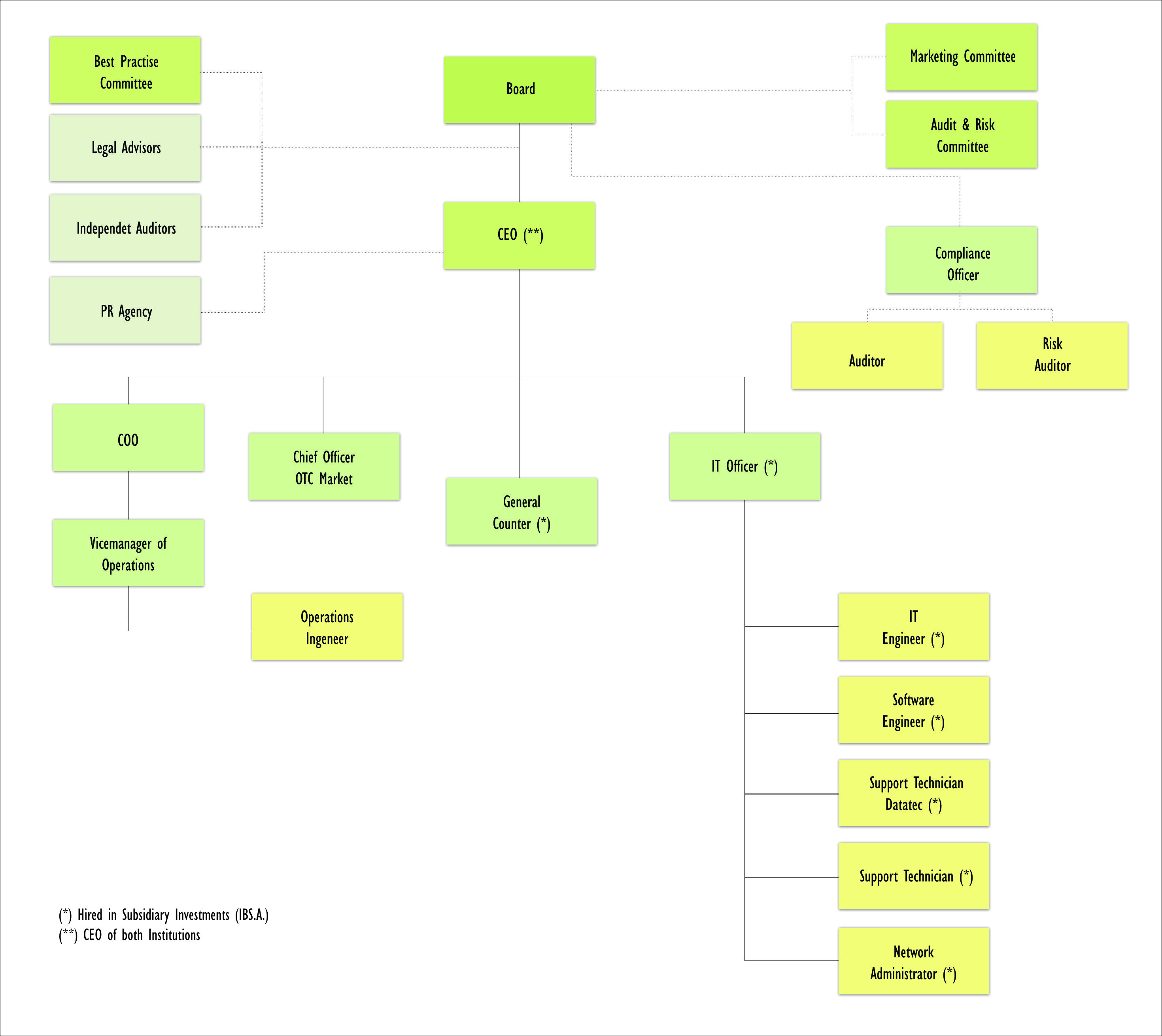

Organization chart

Clearing, settlement and depository services

The compensation and settlement of operations is carried out through the Securities Clearing and Settlement Bureau (CCLV), an entity that regulates the amounts and securities to be transferred by each stockbroker. The deposit and transfer of the traded securities are made through the Central Securities Depository (DCV) and the payments through a bank. The payment terms will depend on the conditions established in the negotiation (payment today, payment tomorrow, normal account, other).

Values and terms reported to the Securities Clearing and Settlement Bureau: Variable Income, Fixed income and Simultaneous.

Responsible entities:

Stock Exchanges: Negotiation is carried out through them and they report transaction to the Securities Clearing and Settlement Chamber or Central Securities Depository for settlement.

Securities Clearing and Settlement Bureau: (CCLV): offset the securities to be settled and make instructions for transfer of securities between brokers to DCV and instructions to the Bank for payment to brokers.

Bank: Deposits and money payments are materialized.

Central Securities Depository (DCV): Transfer of traded values between brokers by instructions of the Securities Clearing and Settlement Chamber or by instructions of the brokers themselves.

Stock Brokers: carries out stock market transactions through these offices, by instructions of its clients.

Member of the following organizations

- Afiliated to the World Federation of Exchanges (WFE) since year 2017

- Member of Federación Iberoamericana de Bolsas (FIAB) since year 2020

Agreements with other Exchanges

2019 – Alliance with Sonda

Cooperation agreement to integrate the RealAiS CdB platform, a Sonda tool aimed at managing the backoffice of stockbroker with the Electronic Stock Exchange (BEC) technological systems.

2017 – Alliance with regional stock exchanges

Programmatic agreement to study the interconnection of stock exchanges with the Electronic Stock Market of Uruguay (Bevsa) and the Electronic Open Market of Argentina (MAE)

2011 – Alliance with Nasdaq

Agreement with one of the most relevant electronic exchanges in the United States, which has made possible to adapt its sophisticated transaction system to the Chilean market, thus becoming the exchange with the highest processing speed in Latin America.

2003 – Alliance with Datatec

Agreement with SIF ICAP that allows to offer in Chile the current and its derivatives transaction system, known as Datatec.