Bolsa de Valores de Caracas

Corporation listed on Bolsa de Valores de Caracas

- Authorities

- Main products and markets

- Main shareholders

- Brokerage firms

- Trading hours

- Market data

- Market capitalization split by economic sector

- Brief history

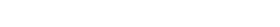

- Organization chart

- Financial indicators

- Clearing, settlement and depositary services

- Central counterparty - CCP

- Member of the following organizations

- Agreements with other Exchanges

Authorities

Chairman

Horacio Velutini Sosa

Vice-Chairman

Emilio Antelo Rey

Board of Directors

Secretary

Gonzalo Alonso Labraga

Director

Fernando Ochoa Panacci

Independent

Aland Acosta

Alternate Directors

Carlos Guruceaga

José Miguel Tineo Raga

Diego Alexandre Parra

María Eugenia Salazar

Camilo Rodríguez

Calle Sorocaima, entre Av. Tamanaco y Venezuela

Edificio Atrium, Caracas, Venezuela

Phone: (58212) 905-5511/5827

www.bolsadecaracas.com

Main products and markets

- Shares

- Fixed Income

- Commercial paper

Main shareholders

BVCa shareholders are the Exchange members themselves. Each member is entitled to hold only one (1) share.Brokerage firms

www.bolsadecaracas.com/eng/casas/casas-puesto.jspTrading hours

Market data

(Additional information at www.fiabnet.org)

Market capitalization split by economic sector

Brief history

The Bolsa de Valores de Caracas (BVC) was founded on January 21, 1947, and it held its first trading session on April 21, the same year, after completing a prior 73-year period of literally trading in the street, at the corner of Bolsa and San Francisco, on Universidad Avenue, at the Caracas historic inner city area.

The institution was born under the name of Bolsa de Comercio de Caracas, including the word comercio (commerce/trade) because, even though it was a stock rather than a commodity exchange, securities brokerage centers could only be created pursuant to the Commercial Code. Later on, after the enactment of the first Venezuelan Capital Markets Law, the Exchange changed its name to the present denomination, becoming a corporation in which each shareholder is entitled to one share and only member brokers are allowed to execute transactions on behalf of their clients. The Extraordinary Shareholders’ Meeting held on May 6, 1976, resolved that the institution should be renamed as Bolsa de Valores de Caracas C.A., and a new corporate structure consisting of 43 shareholders or stockbrokers became operational; a number which, in 1995, rose to 63 members.

Bolsa de Valores de Caracas (BVC) has operated on a wholly electronic basis since February 1992, after putting in place a state-of-the-art electronic trading system developed by the Vancouver Stock Exchange and TCAM, known as SATB (Spanish acronym for “Automated Stock Exchange Transaction System”). In 1995, BVC became the first Venezuelan financial institution to provide information disseminated from its own website.

In 1996, the Central Securities Depositories Law was enacted, and BVC established Caja Venezolana de Valores, which started business operations within such legal framework. A year later, the Automated Financial and Market Information System (SAIBF) and the Automated Online Trading System (SAREL) became operational through the Internet, thus being an integral part of the BVC website. The new Capital Market Law entered into force on October 22, 1998, and it granted autonomous functions to the National Securities Commission.

In May 2000, the new Integrated Electronic Market System became operational for fixed-income securities trading; whereas integrated electronic equity trading started on July 2, the same year.

The equity market has recorded significant changes. Progress has been made in prompt trade settlement, by shortening settlement terms from 5 to 2 days; while efforts are now being focused on streamlining payment systems, and improving electronic trading platforms and central securities depositories. Electronic trading has been implemented consistently with an advanced web-based Exchange Portal, a specific link has been created between the Exchange trade execution system and the Central Bank of Venezuela Electronic Securities Custody System (SICET).

Likewise, great strides have been made in other areas, as shown by the launch of a Corporate Social Responsibility (CSR) program and the operation of the Venezuelan Capital Market Institute.

At present, with direct online connectivity to our institution, investors worldwide can obtain information on market quotes and trades through data vendor computer terminals and BVC web-based data services, or by directly making inquiries to our member brokerage firms.

This Stock Exchange, which is unique in Venezuela, has recently witnessed a significant development as a financial intermediation center using advanced technology in the design and operation of its IT trading systems.

Organization chart

Financial indicators

Clearing, settlement and depositary services

Every securities transaction executed on Bolsa de Valores de Caracas is cleared and settled through the Venezuelan clearing corporation CVV Caja Venezolana de Valores C.A. Funds settlement is performed by the Caracas Stock Exchange itself, under a delivery versus payment (DvP) scheme.

Settlement terms

Ordinary transactions T + 2

Cash/spot transactions

Forward transactions: 3 to 60 days

Custody is performed by “Caja Venezolana de Valores”.

Central counterparty - CCP

A Central Counterparty mechanism is not available.

Member of the following organizations

- Cámara de Comercio e Industria de Caracas – 1947

- Consejo Nacional de Promoción de Inversiones (Conapri) – 1990

- Federación Iberoamericana de Bolsas (FIAB) – 1973-2002/ 2003

Agreements with other Exchanges

- Sociedad Rectora de la Bolsa de Madrid – 1998

- Bolsas y Mercados Españoles Consulting C.A. – 2004

- CVV Caja Venezolana de Valores