Bolsa y Mercados de Valores de la República Dominicana

Non-listed Corporation

Freddy Domínguez Castro - Chairman

Authorities

Independent Members

Chairman

Freddy Domínguez Castro

Vice-Chairman

Marcos Peña Rodríguez

Treasurer

Pilar Haché Nova

Member

Gustavo Volmar Álvarez

Laura Peña Izquierdo

Carlos Manuel Tejera

Campos De Moya Fernández

Shareholders

Lynette Castillo- BHD Puesto de Bolsa, S.A.

Alejandra Valdez- Inversiones & Reservas, S.A.

José Yude Michelen- Alpha Sociedad de Valores, S.A.

José Antonio Martínez- Bolsa de Comercio Santiago, Bolsa de Valores

Executive Vicepresident/General Manager

Elianne Vílchez Abreu

Calle José Brea Peña 14, Edificio BVRD

Evaristo Morales, Santo Domingo, Dominican Republic

Phone: (1 809)-567-6694

www.bvrd.com.do

Main products and markets

- Fixed income

- Shares (Fund units and Trusteeship Values)

Main shareholders

Alpha Sociedad de Valores, S.A.BHD Puesto de Bolsa, S. A.

Inversiones Popular Puesto de Bolsa, S.A.

JMMB Puesto de Bolsa , S.A.

Parallax Valores Puesto de Bolsa, S.A.

UC-United Capital Puesto de Bolsa, S.A.

Excel Puesto de Bolsa, S.A.

Brokerage firms

www.bvrd.com.do/puestos-de-bolsaTrading hours

Market data

(Additional information at www.fiabnet.org)

Brief history

On April 5, 1980, a group of businessmen began to meet in order to formalize a stock market; and create a regulatory entity that would ensure the transparency and efficiency of operations in said market.

This group made up of Ricardo Valdéz Albízu, Hector Rizek, Ramón Mena, Winston Marrero, Otto Montero, Frederic Eman-Zadé, Luis Sabater and Rosendo Alvarez III, was called the Management Committee.

In mid-1986, the Chamber of Commerce and Production of the National District, headed by its President, Mr. Felipe Auffant Najri, expressed his interest in the project to the Management Committee, which accepted from that moment on to continue directing the project with the support of the Chamber of Commerce. In this way, the efforts to shape the creation of the Santo Domingo Stock Exchange Inc. are accelerated.

Among the first steps that were taken was to hire the advisory services of Mr. Robert Bishop, retired Vice President of the New York Stock Exchange, to carry out a feasibility study on the creation of a Stock Exchange, and then issue the recommendations of place .

On November 25, 1988, the Executive Power issues its decree No. 544-88 which gives life to the Santo Domingo Stock Exchange Inc., as a non-profit entity and fully sponsored by the Chamber of Commerce and Production of the National District, its main objective being the creation of a secondary market that promotes and facilitates the channeling of savings towards investment through the commercialization of securities.

By 1997, the exchange’s operations had spread to other parts of the country, and it had become a national exchange. For this reason, on March 31, 1997, the name of the Santo Domingo Stock Exchange, Inc. was changed to the Dominican Republic Stock Exchange, Inc., in order to adapt it to the correct dimension of its operations.

On May 8, 2000, Law 19-2000 on the Stock Market was approved by the Executive Branch, the main objective of which is to regulate and promote the stock market in an organized, efficient, and transparent manner, contributing to the development economic and social of the country.

On March 19, 2002, the Regulation of the Securities Market Law is approved under decree 201-02, with the fundamental objective of regulating under coherent rules that contribute to strengthening the activities of the stock market, as well as establishing the control and supervision mechanisms necessary for their development.

On October 10, 2003, the Securities Superintendence granted the BVRD the authorization to operate and register in the Securities and Products Market Registry, after having complied with the requirements established in the Securities Market Law No.19-00. , its Application Regulations and the provisions set forth in the First Resolution of the National Securities Council of December 17, 2002.

As of 2005, the operations of the BVRD are reactivated with the release on the market of a bond issue in pesos of the Leasing Popular company for an amount approved, according to the BVRD resolution, of RD$1,500,000,000.00.

2009 the market advances with the dematerialization project of the financial instruments of the Treasury and the Central Bank of the Dominican Republic, giving greater importance to the Stock Market as it is the one that manages the trading platform.

In 2011, the Bloomberg Trading Platform was successfully implemented, which enabled the entity to provide administration services for the Market Makers program of the Ministry of Finance.

In 2014, the operations of the SIOPEL Stock Trading Platform began, which enabled the operations of fixed-income instruments and investment fund quotas and public offering trusts.

In 2015, the BVRD continues its process of strengthening affiliated companies with the introduction of the RDVAL Price Provider Society, becoming the only authorized and independent Price Provider company that provides daily valuation of financial instruments traded in the Dominican stock market, as well as their respective yield curves.

That same year, the incursion of new Variable Income instruments such as Closed-End Real Estate Investment Funds, Closed-End Funds for Company Development and Public Offering Real Estate Trust was notable.

In 2017, with the promulgation of the new Capital Market Law 249-17, a process of operational, corporate and regulatory adaptation of the institution began, to comply with the figure of the managing company of centralized trading mechanisms.

In 2021 the Strategic Alliance between the Bolsa y Mercados de Valores de la República Dominicana with the Santiago de Chile Stock Exchange, this historical milestone opened the doors to a capital market with greater liquidity, growth and new fields of negotiation, contributing to the development of innovative transactional mechanisms that encourage best corporate practices while ensuring dynamism in the financial system.

During that same year, Law 163-21 for the Promotion of the Placement and Commercialization of Publicly Offered Securities was promulgated. The BVRD participated in the preparation of the draft law and coordinated with the sectors involved to lay the foundations for it.

We also received the inclusion for the first time of the BVRD in the Executive Committee of the Ibero-American Federation of Stock Exchanges (FIAB), managing to participate more actively in this important platform for cooperation and integration of the Ibero-American Stock Exchanges and Markets.

We continue to strengthen our value proposition in 2022, with the launch of the new Sebra HT Trading Platform, the main deliverable of the Strategic Alliance with the Santiago de Chile Stock Exchange, counting on technology as a central ally in the management of operations, guaranteeing modern and sustainable tools that meet the needs of our users and encouraging the planning of future business opportunities that transcend borders.

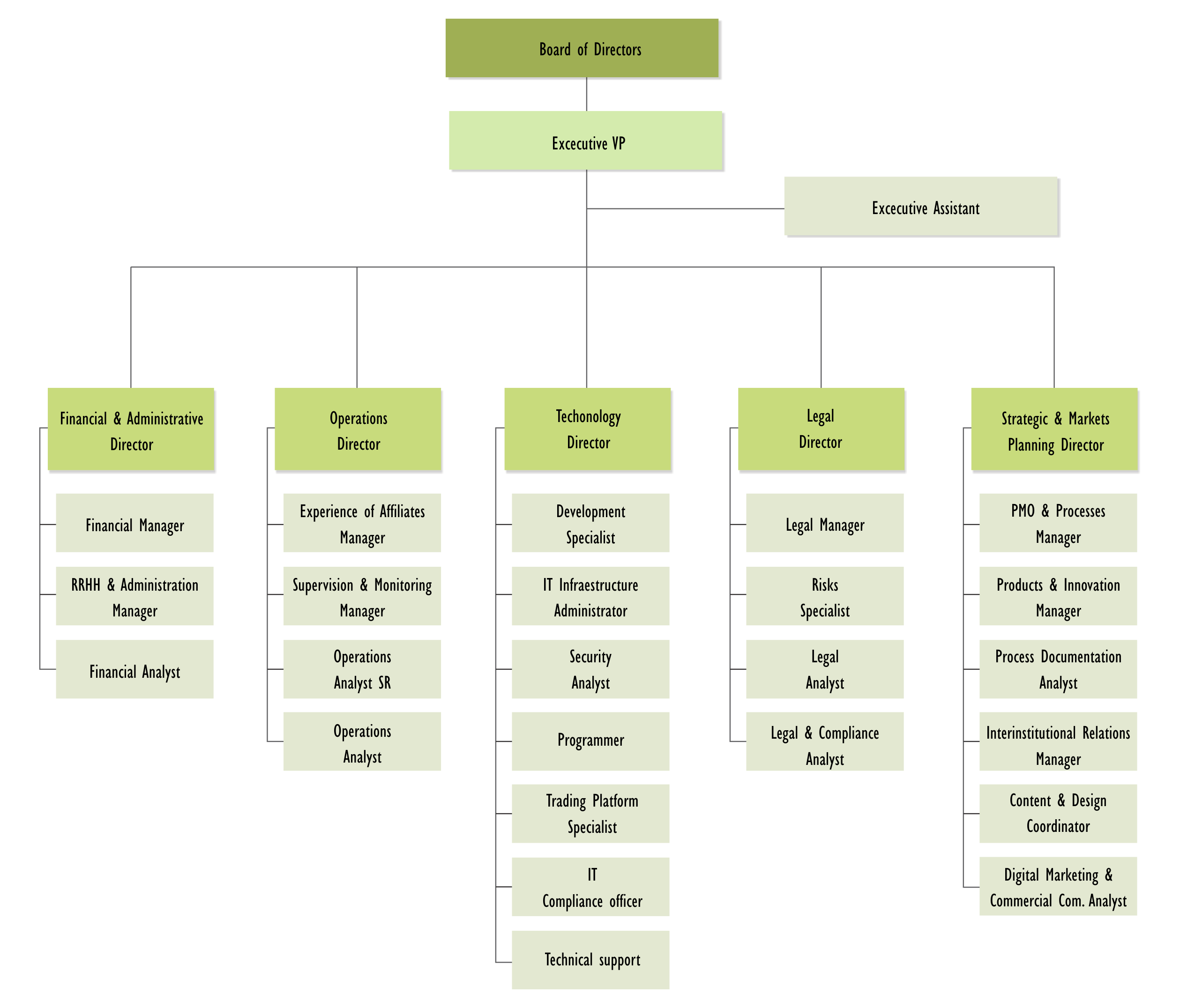

Organization chart

Financial indicators

Clearing, settlement and depositary services

For purposes of providing these services, Bolsa de Valores de República Dominicana has created Central Securities Depository CEVALDOM S.A., in which BVRD has a 32.50 percent ownership interest.

Central counterparty - CCP

A Central Counterparty mechanism is not available.

Member of the following organizations

- Cámara Americana de Comercio (AMCHAMDR) – May 2011

- Cámara de Comercio Española – May 2011

- Federación Iberoamericana de Bolsas (FIAB) – September 2009.

- Consejo Nacional de la Empresa Privada (CONEP) – March 1997

- Asociación de Bolsas de Centroamérica y el Caribe ( BOLCEN)

Agreements with other Exchanges

BVRD has not entered into agreements with other Stock Exchanges.