Bolsa de Valores de Montevideo

Corporation (on process)

- Authorities

- Main products and markets

- Brokers and special members

- Trading hours

- Market data

- Market capitalization split by economic sector

- Brief history

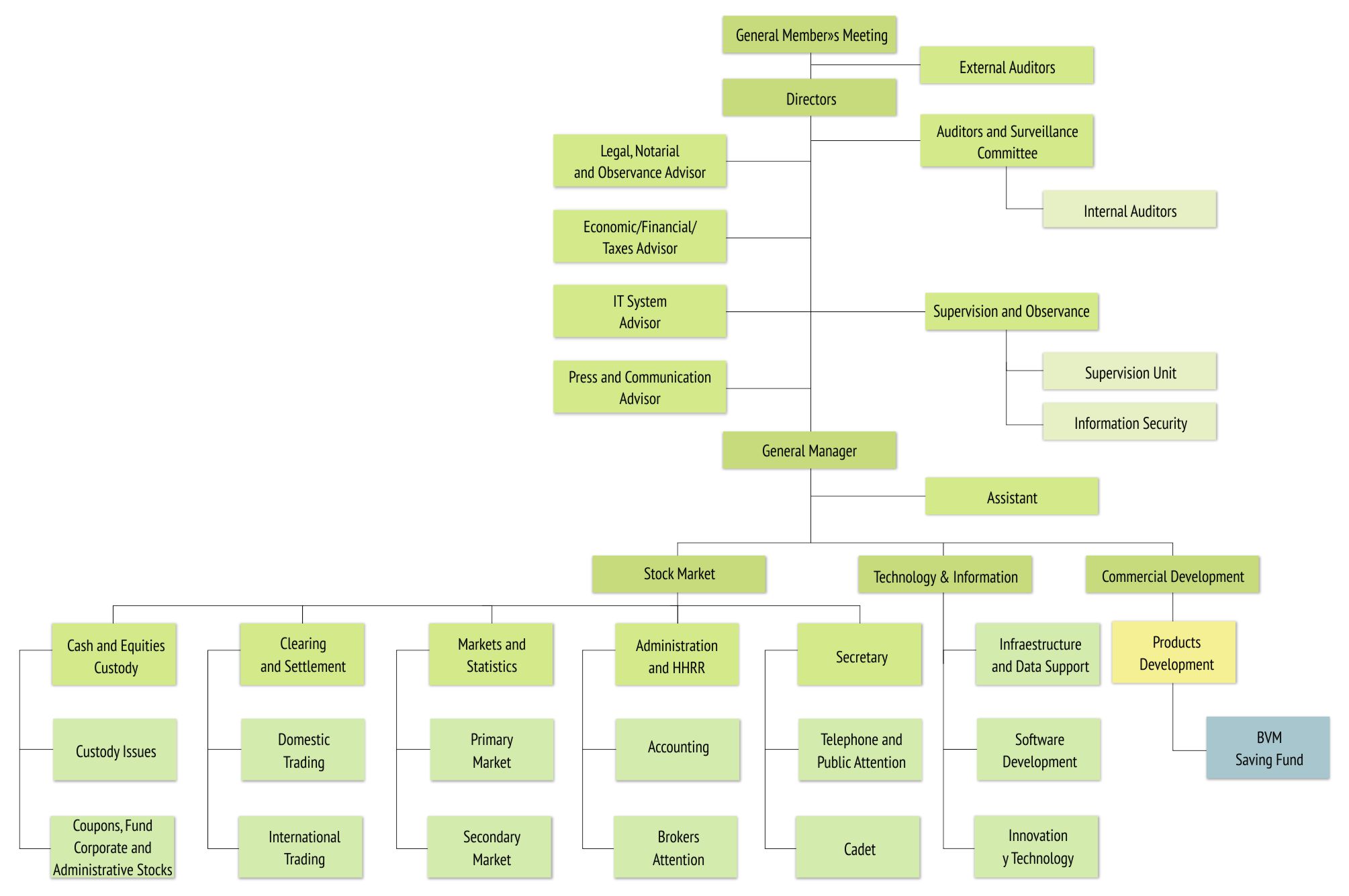

- Organization chart

- Financial indicators

- Clearing, settlement and depositary services

- Central counterparty - CCP

- Member of the following organizations

- Agreements with other Exchanges

Pablo Sitjar- Chairman

Authorities

Chairman

Vice-Chairman

Víctor Paullier

Secretary

Jorge Davison

Board of Directors

Fabricio Pascuali

Rodolfo Rebella

Fernando Pollio

Diego Pozzi

General Manager / CEO

Marcelo Oten

Misiones 1400

(11000) Montevideo, Uruguay

Phone: (5982) 916-5051

www.bvm.com.uy

Main products and markets

- Government Bonds

- Domestic shares

- Corporate bonds

- Pension bonds

- Financial trust

- “Uruguay” Eurobonds

- Foreign sovereign bonds

- Multilateral loan agencies instruments

- Short Term Instruments – Primary Market

- Short Term Instruments – Secondary Market

Brokers and special members

www.bvm.com.uy/bolsa/index.php?option=com_wrapper&Itemid=196Trading hours

Market data

(Additional information at www.fiabnet.org)

Market capitalization split by economic sector

Brief history

In 1867 a few years after than the country left behind La Guerra Grande, – the armed confrontation that was the cradle of the traditional currency-, the Sociedad de Bolsa Montevideana began to operate in Uruguay.

The institution appeared with the aim to give the main business-men of that time a daily meeting point where to deal their business, in an hour settled in advance.

A brochure of that time introduced the stock Exchange as a progress instrument to approach companies to small capitals. In 1921 the Internal Commission of Stock brokers (Comisión Interna de Corredores) became a non-profit association, and started to operate as a place to perform exchange transactions as well as for the stock brokers union.

In 1952, this Comission started to be called Bolsa de Valores. In 2004 adopted the name of Bolsa de Valores de Montevideo, and nowadays it is called Bolsa de Valores de Montevideo-Uruguay.

Until 1928 the old headquarter of the Bolsa de Valores was located in Piedras and Zabala, where Banco República’s main office works today.

The current building –placed in the iconic corner of Rincón and Misiones- was opened in July 18th, 1940 with the presence of Alfredo Baldomir, the President at that time.

But what is outstanding in the profuse life of the institution was the role that it played in Uruguay between the end of XIX century and the beginning of XX century, considering many of the biggest entrepreneurships that the country faced, began to develop getting capital from the stock market.

In the Bolsa de Valores were traded instruments that made possible the construction of emblematic buildings such as the Solís Theater, the South Rambla, and different entrepreneurships of the Intendencia de Montevideo and even the Palmar dam.

Not less important is that along the years, stocks of important companies in the history of the country such as Funsa, Fábrica Nacional de Papel, Salus, Aluminios del Uruguay, Cristalerías, Conaprole and Pamer, among others, have been bought and sold in its building.

Nowadays, the Bolsa de Valores de Montevideo-Uruguay is going through a process that will let it, go on being one of the engines that promotes the developing of the country, through the correct canalization of Uruguayan’ savings.

The central axis of the present work of the institution are based on the search of strengthening of the stock markets, financing companies projects, promoting the financial inclusion and the creation of instruments that allow investors and public in general, the access to saving and to capital market.

All this, without neglecting its presence in the stock markets of the region, as well as developing bonds with international organizations such as CAF -Banco de Desarrollo para América Latina- and with different exchanges of the region grouped together in the Iberoamerican Federation of Exchanges.

During all its evolution, the Bolsa has based its actions on fundamental values that has been transmitted from generation to generation, such as professionalism, trust, safety and transparency.

Organization chart

Financial indicators

Clearing, settlement and depositary services

Since 1997, under the scope of agreements with local and foreign Banks, and its Central Bank of Uruguay accounts, BMV provides clearing, settlement, and custody services for both domestic and foreign securities. Domestic securities trades are settled on T+1, and foreign securities transactions are settled on T+3. The Stock Exchange does not guarantee trade settlement, the settlement mode is delivery versus payment (DvP), and it has buy-in facilities available in case brokers fail to settle any transaction.

Central counterparty - CCP

A Central Counterparty mechanism is not available.

Member of the following organizations

- Federación Iberoamericana de Bolsas (FIAB) – 1973

- America’s Central Securities Depositories Association (ACSDA) – 1999

Agreements with other Exchanges

- Bolsa de Valores y Productos de Asunción – Paraguay – July 2011 – Cooperation agreement

- MOU with ROFEX Uruguay Bolsa de Valores y Futuros SA for rpmotion and provide with the stock market.