Mercado Argentino de Valores – MAV

Corporation listed on Bolsa de Comercio de Rosario

Authorities

Chairman

Alberto Daniel Curado

Vice-Chairman

Pablo Alberto Bortolato

Secretary

Mario Augusto Acoroni

Treasurer

Carlos José Canda

Regulars Directors

Jorge Amadeo Baldrich

Gustavo Rubén Badosa

Jorge Eduardo García

Sebastián Arena

Martín Sebastián Baretta Elisei

Eduardo Vicente Afflitto

Alternates Directors

Nicolás Herrlein

Guillermo Moretti

Rodolfo Federico Allasia

Surveillance Board

Regular Members

Luis Alberto Abrego

Pablo Luis María de Estrada

Esteban Lorenzo

Alternate Members

Miguel Benedit

Marcelo José Rossi

Lisandro Daniel Nasini

Executive Director

Fernando J. Luciani

Paraguay 777

(2000) Rosario, Santa Fé, Argentina

Phone: 54 (341) 4469100

Main products and markets

- Deferred Payment Check

- Echeck

- Stock market promissory note

- Electronic Credit Invoice

- SME company shares

- SME Negotiable Obligations

- Financial Trusts

- passes

- Municipal and provincial financing

Main shareholders

| Bolsas y Mercados Argentinos S.A. | 20% |

| Bolsa de Comercio de Rosario | 17,37% |

| Bolsa de Comercio de Mendoza S.A. | 5% |

| Bolsa de Comercio de Buenos Aires | 5% |

| Bolsa de Comercio de Santa Fe | 2% |

| Rofex Inversora | 2% |

| Bolsa de Comercio de Bahía Blanca S.A | 2% |

| Bolsa de Comercio de Córdoba | 2% |

Brokerage firms

www.mav-sa.com.ar/agentes/agentes-mav/Trading hours

Brief history

The Argentine Stock Market S.A. It is the most important market in the country in the structuring of products and businesses linked to small and medium-sized companies, non-standardized products in general, and regional economies.

It was born in 1927 as the first public limited company in the country that decided to create a Stock Market. At that time the denomination chosen was “Mercado de Titulos y Cambios de Rosario”, later it changed to “Mercado de Titulos y Cambios de la Bolsa de Comercio de Rosario S.A.” to later become “Mercado de Valores de Rosario”, a company name that lasted until 2013 when Mervaros merged with Mercado de Valores de Mendoza, changing its name to Mercado Argentino de Valores S.A. driven by the spirit of Law No. 26,831 on Capital Markets or LMC.

The Argentine Stock Market S.A. starred in a true redesign that positions it as a leading market in terms of technological standards, product specialization and dynamism when it comes to providing its Agents with a personalized service.

This specialization and segmentation of products allows the MAV to exclusively offer operations of Deferred Payment Checks, Echeq, Promissory Notes, Invoices, Shares of SME companies, SME Negotiable Obligations, Financial Trusts, Passes and provincial and municipal Financing. Instruments designed to promote the development of regional economies and SMEs in the country.

The MAV provides an exclusive “Turnkey” service for the incorporation of Trading Agents. It carries out financing and investment operations with negotiable securities and has a very satisfactory DMA scheme (Direct Market Access for the client). It provides services to companies, institutions and Agents throughout the country in an agile and efficient manner.

The MAV Group strengthens and expands the commercial options of our Agents by integrating ROSVAL, AUNE, ROSFID and AXIS.

Likewise, the MAV incorporated all the main Stock Exchanges and Markets in the country into its share capital as “Strategic Partners” thinking of those who, due to their history, trajectory, turnover, territorial and regional enclave, specialization, seniority or strength institutional within the Capital Market, qualifies the MAV, giving it value.

Its headquarters are located in the city of Rosario and it has commercial offices in C.A.B.A and Mendoza.

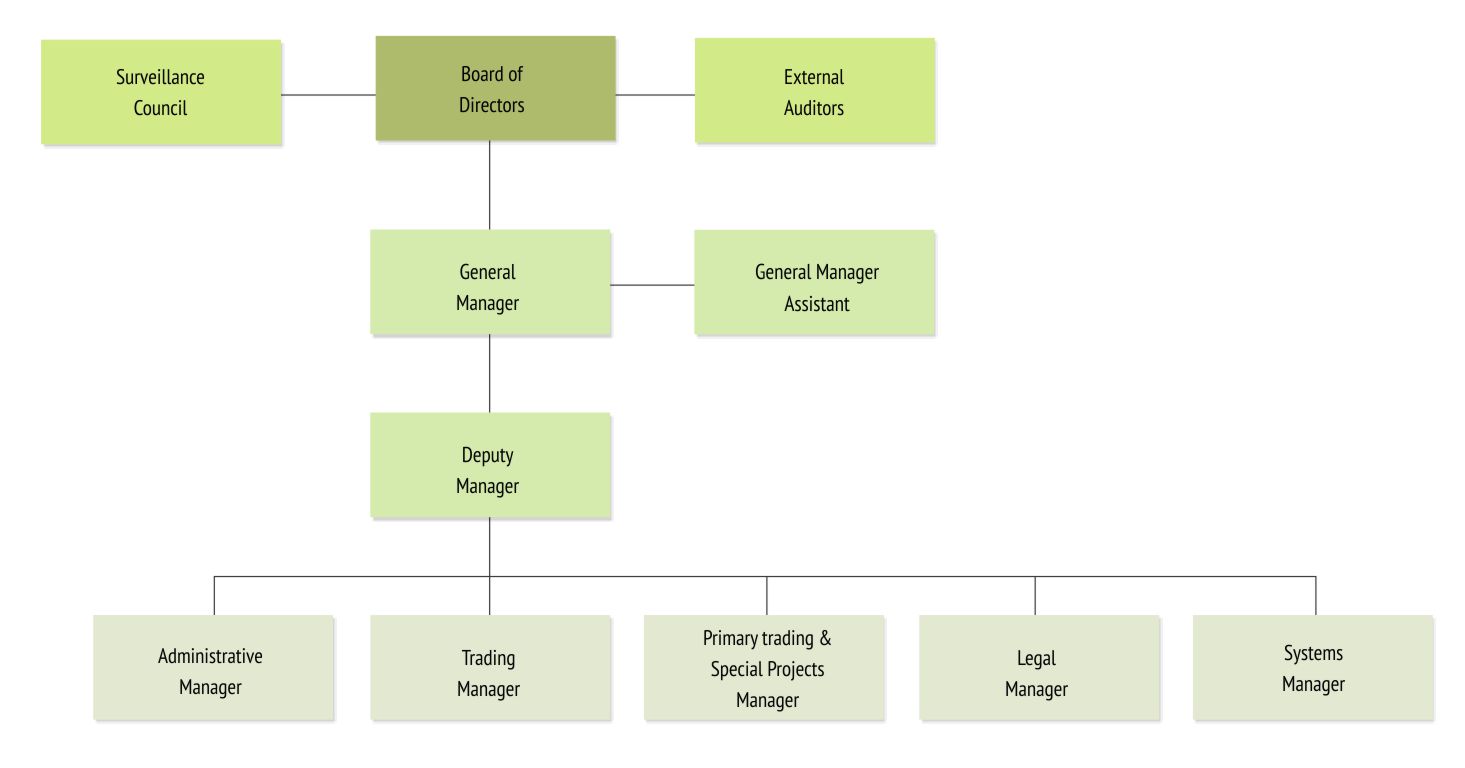

Organization chart

Financial indicators

Clearing, settlement and depositary services

The Argentine Stock Market – MAV, is the only market in Argentina specializing in financing for small and medium-sized companies, regional economies and non-standard instruments. Within this framework, it concentrates all financing products for MSMEs, subnational governments and the real economy.

This specialization and segmentation of products allows the MAV to exclusively offer operations of Deferred Payment Checks, Echeq, Promissory Notes, Invoices, Shares of SME companies, SME Negotiable Obligations, Financial Trusts, Public Securities and Provincial and municipal Financing. Instruments designed to promote the development of regional economies and companies in the country.

In this way, every day through the Argentine Stock Market, thousands of MSMEs are financed for productive purposes, that is, MAV stimulates financing for the sector that represents 90% of Argentine companies and generates 70% of employment. .

They are shareholders of MAV, hundreds of minority investors and all the Stock Exchanges of the country. Meanwhile, with a network of more than 210 Agents throughout the country, MAV federalizes and enhances the access of MiPyMEs to the Capital Market.

Member of the following organizations

- Federación Iberoamericana de Bolsas (FIAB) – 1980

Agreements with other Exchanges

The Rosario Stock Market merges with the Mendoza Stock Market, changing its name to Mercado Argentino de Valores S.A., driven by the spirit of Law No. 26,831 on Capital Markets or LMC.

Specialization agreement between Argentine Stock Exchanges and Markets and the Argentine Stock Market -August 20, 2014-. This framework agreement allows the MAV to take under its exclusivity -on a national basis- the negotiation of instruments for SMEs and non-standardized products in order to promote the development of regional economies. While BYMA is in charge of the core products, basically shares and government bonds.

Framework Agreement with the Córdoba Stock Exchange -March 28, 2016-. With the aim of promoting greater federalization and achieving better access to financing for SMEs in the Capital Market, the parties agree to authorize the BCC to receive those instruments whose purpose is to operate in MAV, guaranteeing formal regularity. of the same and so that they can later be deposited in the collective deposit entity defined by MAV.

In September 2017, the “Framework Agreement for Technical Cooperation between the Ministry of Science, Technology and Productive Innovation and the Argentine Stock Market S.A.” was signed. with the purpose of providing the provision of financial operational support for the Argentine Innovation Market Platform, hereinafter MIA, for the implementation of the crowdfunding modules.

Framework Agreement with the Santa Fe Stock Exchange -October 31, 2019-. With the aim of promoting greater federalization and achieving better access to financing for SMEs in the Capital Market, the parties agree to authorize the BCSF to receive those instruments whose purpose is to operate in MAV, guaranteeing formal regularity. of the same and so that they can later be deposited in the collective deposit entity defined by MAV.

MAV Information Exchange Agreement – Nosis -November 27, 2019-. MAV provides NOSIS with public information about negotiable securities (checks, promissory notes, invoices, etc.) acquired by its clients and NOSIS will comply in publicizing such VN to third parties by incorporating the data provided by MAV into its commercial reporting services.